Featured Articles

-

"Charlie Munger: The Life and Legacy of our Late, Eminent Friend" 266.92 KB

Winter 2024 -

"A Whale of a Tale: The History of Venture Investing in the United States" 404.74 KB

Fall 2023 -

"The Panic of 1819, Silicon Valley Bank and the Danger of Bank Runs" 704.16 KB

Summer 2023 -

50 Years of Exchange-Traded Options: Cboe Marks Its Golden Anniversary 480.63 KB

Spring 2023 -

Gender and the Dismal Science 258.75 KB

Winter 2023 -

The Story of Hetty Green 551.83 KB

Fall 2022 -

International Sanctions 462.41 KB

Summer 2022 -

Religion and the Rise of Capitalism 458.74 KB

Spring 2022 -

Bread & Roses: Not Just Subsistence, but Dignity 897.83 KB

The 1912 Lawrence Textile Strike set precedents for industry-wide action, inter-ethnic collaboration and women’s leadership.

Winter 2022 -

"Markets of the Roaring '20s" 727.19 KB

Fall 2021 -

"Populist Prophets, Public Profits" 375.69 KB

Summer 2021 -

"A New History of Financial Bubbles" 314.61 KB

Spring 2021 -

Seeking Virtue in Finance 228.36 KB

Winter 2021 -

Free Business People of Color: Antebellum Black Business Owners in New Orleans and Charleston 288.31 KB

Fall 2020 -

New Deal or Raw Deal? Black Americans in the Roosevelt Years 1.53 MB

Summer 2020 -

Financial History, Issue 133 493.58 KB

Spring 2020 -

Bubbles and Gullibility 619.28 KB

Examining the relationship between bubbles and gullibility, then and now.

Winter 2020 -

US Presidents and the Federal Reserve 308.02 KB

Fall 2019 -

'A Commercial Emancipation' for the Negro 329.44 KB

Summer 2019 -

From Tariffs to Taxes 424.44 KB

Spring 2019 -

2019 MoAF Gala Remarks 175.71 KB

Winter 2019 -

Annual Shareholder Meetings: From Populist to Virtual 842.97 KB

Fall 2018 -

The Gambler: The Rags-to-Riches Story of Deal Maker Kirk Kerkorian 892.98 KB

Summer 2018 -

Warren Buffett: Learning Through the School of Hard Knocks 348.02 KB

Spring 2018 -

A First-Class Catastrophe 822.96 KB

Winter 2018 -

Where Are They Now? 8.57 MB

Fall 2017 -

Ladies of the Ticker 1.00 MB

Summer 2017 -

The Personal, the Political and the Profitable 196.72 KB

Spring 2017 -

Spies, Abolitionists and the Origins of Credit Rating Agencies 414.26 KB

Winter 2017 -

'Our Whole System is in Disorder': Alexander Hamilton as a Revolutionary Reformer 591.41 KB

Fall 2016 -

Women on Money 1.01 MB

A new exhibit at the National Museum of American History places the redesign of US paper money into a global context and demonstrates that women have appeared on money from ancient times to today.

Summer 2016 -

Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism 363.64 KB

Spring 2016 -

The Woman Who Dueled with Aaron Burr...and Won 394.44 KB

Winter 2016 -

Warren Buffett and Wall Street: The Best of Frenemies 526.58 KB

Examining Buffett's relationship with Wall Street on the 50th anniversary of his leadership of Berkshire Hathaway.

Fall 2015 -

When Cleveland Was Motown 354.34 KB

From wringers, to luxury cars to beer, Peerless was a pioneer of reinvention.

Summer 2015 -

"John Whitehead: Wall Street Leader, Cold Warrior, Friend to Thousands" 405.63 KB

Tribute to a champion of ethics and integrity on Wall Street.

Spring 2015 -

Financial History, Issue 112 425.02 KB

The role debt played in replacing 13 sovereign states with one energetic national union in the late 1780s.

Winter 2015 -

"Plundered by Harpies: An Early History of High-Speed Trading" 605.78 KB

An early history of high-speed trading.

Fall 2014 -

"The Evolution of Value Investing" 329.26 KB

Categorizing the past, present and future of one of finance's most influential schools of thought.

Spring 2014 -

"Heard on the Street, and Around the World" 161.51 KB

The Wall Street Journal turns 125 years old.

Winter 2014 -

"Central Banking and the Incidence of Financial Crises" 2.05 MB

By acting as a lender of last resort to other banks and financial institutions, history shows that a central bank can both prevent crises and alleviate their economic damage when they do occur.

Fall 2013 -

"The Colonial Public Lottery" 314.79 KB

Summer 2013 -

"Profit From Prudence" 158.89 KB

Examining the difference between Canadian and US banks during the recent financial crisis.

Spring 2013 -

"King of the Bucket Shops" 541.66 KB

T. Brigham Bishop caters to female investors, but when finance turns to fraud he cannot outrun a woman scorned.

Winter 2013 -

"A Museum of Finance: Why?" 705.87 KB

Exploring the power of finance in history.

Fall 2012 -

"McDonald's and the New Franchising Paradigm" 298.78 KB

The financial innovations of the world’s largest food purveyor.

Summer 2012 -

Financial History, Issue 102 468.49 KB

How Ralph Kramden brought down Casey Jones, in which a cartoon rabbit and a very real civil-rights heroine also appear. Exploring the National City Lines conspiracy.

Winter 2012 -

"Checks & Balances: Three Epochs of Federal Budget Management" 846.18 KB

The history of the US government's management of its budget can be divided into three great eras: the age of surpluses, the age of transition and the age of deficits.

Fall 2011 -

"A Profitable Century of Prudence" 1.49 MB

Special Full-Color Double Edition

Spring/Summer 2011 -

The Antibubble: Thomas Willing and Early American Financial Stability 330.32 KB

Biographical profile of the man who was perhaps the most important of America's lesser-known financial founding fathers.

Winter 2011 -

"Boom, Bust and Crisis," by Robert E. Wright 677.39 KB

How the colonial real estate crisis of the 1760s turned Sheriff John Morton into a rebel.

Fall 2010 -

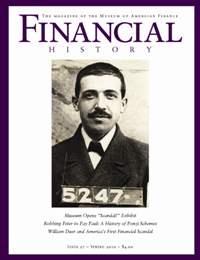

"Robbing Peter to Pay Paul: Ponzi Schemes Throughout History" 566.10 KB

A history of Ponzi schemes, from Charles Ponzi to Bernie Madoff.

Spring 2010 -

"Ernesta Procope: Profile of a Trailblazing Black Businesswoman" 312.25 KB

Profile of the trailblazing black businesswoman who transformed E.G. Bowman from a storefront to America's largest minority-owned broker.

Winter 2010 -

"For Us or For Them? Bailouts Then and Now" 368.61 KB

Should the U.S. government, or any government for that matter, use public money to stabilize a disintegrating financial system? Theory backed by historical experience suggests that it should, but only if it does so in just the right way.

Fall 2009 -

Probability, Gambling and the Origins of Risk Management 143.26 KB

The Chevalier de Méré, a 17th century gambler and dabbler in mathematics, once asked Blaise Pascal a question that began a revolution in the way people think about the future. Many historians trace the origins of modern risk management back to de Méré’s question. De Méré probably had no intention of starting a revolution; his interest in mathematics sprang primarily from the realization that it could make him a better gambler. The question, which he evidently posed to several mathematicians, had to do with solving “The Problem of Points.”

Winter 2009 -

Another Financial Hurricane 832.41 KB

While we have all heard the phrase "history repeats itself," very few people properly apply long-term history to investing. Worse yet, the default assumption of most investors is to think it's different this time and find themselves buying into financial bubbles or cashing out near a bear market low. Clearly, investors need to spend more time studying investment history. A good place to start is by studying past market corrections and what happened during the years that followed.

Fall 2008 -

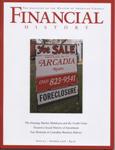

The Housing Market Meltdown and the Credit Crisis 259.33 KB

When the U.S. housing bubble fully burst in 2007 and home prices dropped, 1.25 million subprime mortgages foreclosed, up 80% from 2006. Projections of 2.5 million foreclosures for 2008 seem likely. Over $1 trillion in subprime mortgages will likely be revalued at 60-80% of their original value before the home mortgage crisis and subsequent, but related, credit crisis is worked through.

Summer 2008 -

A Nation of Counterfeiters 2.23 MB

Few of us question the little slips of green paper that come and go in our wallets, purses and pockets. While we may obsess over how much we have at any one time, we do not subject the notes themselves to close scrutiny: most of us cannot remember (without looking) which scene goes with what denomination, or even the secular saints whose portraits adorn the front. Our ignorance is a testament to just how secure we feel about the currency and how little we need to question the underlying value of these scraps of paper. The money is in our hands, it is green, and it has a number on it: that is all we need to know. It was not always so. In the years between the Revolution and the Civil War, money inspired not faith, but nagging doubt and scrutiny.

Spring 2008 -

The Panic of 1907 991.34 KB

To understand fully the Crash and Panic of 1907, one must consider its context: it was a time somewhat like the present. A Republican moralist was in the White House. War was fresh in mind. Immigration was fueling dramatic changes in society. New technologies were changing people's everyday lives. Business consolidators and their Wall Street advisers were creating large, new combinations through mergers and acquisitions, while the government was investigating and prosecuting prominent executives -- led by an aggressive young prosecutor from New York. The public's attitude toward business leaders, fueled by a muckraking press, was largely negative. The government itself was becoming increasingly interventionist in society and, in some ways, more intrusive in individual life. Much of this was stimulated by a postwar economic expansion that, with brief interruptons, had lasted about 50 years, although in recent months a major natural disaster had disturbed the equilibrium of the nation's fragile financial system. As Mark Twain supposedly said, "History may not repeat itself, but it occasionally rhymes."

Fall 2007 -

Attention Shoppers 571.73 KB

Since its inception in 1886, Sears has issued many glossy publications filled with numbers and descriptions. Most of those have been catalogues, with dazzling copy written by Richard Sears himself. But exactly 100 years ago the firm issued a different publication filled with numbers and descriptions: its first annual report.

Spring 2007 -

Alexander Hamilton Central Banker and Financial Crisis Manager 1.92 MB

Wall Street suffered its first crash in March 1792. In a matter of weeks, U.S. government securities comprising the national debt lost a quarter of their value. Shares of the Bank of the United States, founded in 1791, fell 30 percent. Shares of the new Society for Establishing Useful Manufactures fell 45 percent. A more seasoned issue, Bank of New York shares, declined just under 20 percent. Defaults and bankruptcies were numerous. As confidence and trust collapsed, a pall fell over New York and, to a lesser extent, the Philadelphia and Boston securities markets. But potentially damaging economic consequences of the panic were avoided, it is now quite clear, by very modern central-bank-like interventions orchestrated by Secretary of the Treasury Alexander Hamilton.

Winter 2007 -

Graham In Perspective 437.90 KB

Historical analysis reveals that Graham's contributions to investment "theory" were less significant for their originality than for their synthesizing quality. His actual contribution was to bring together and focus currents in investment thought already in existence. To appreciate that vital contribution and place his legacy in perspective, we must examine how conceptions of investing changed during the early 1900s.

Summer 2006 -

War Rooms within War Zones 294.26 KB

Cutthroat deals, take no prisoners, war rooms; the language of combat is often used to describe the world of business. But throughout history, the cliched comparison has been no mere metaphor for many stock exchanges. The crippling or disruption of exchanges by wars is nothing new, from the New York Stock & Exchange Board (today's NYSE) suspending trading in seceding states in 1861, to the arduous history of the Belgrade Stock Exchange, to the 1983 suspension of the Beirut Stock Exchange after nearly a decade of civil war in Lebanon. It reopened in 1995.

Winter 2006 -

The Revenue Act of 1936 400.78 KB

The Revenue Act of 1936 was the most important event in the history of the mutual fund industry: It accorded special tax treatment to mutual funds, putting fund shareholders on a par with direct investors in securities.

Fall 2005 -

Alexander Hamilton and the Birth of a Captial Market 413.35 KB

Capital markets are wondrous things. No nation with a good one is poor; no nation without one is rich, unless one counts as wealth the income reaped by the temporary exploitation of oil and gold, blood and bone. Alas, institutions as complex as capital markets do not usually arise of their own accord. To flourish, as they have in America, they typically require, at a minimum, political stability and a helpful hand from on high. Alexander Hamilton provided both.

Spring 2005 -

The Great Crash of 1929 At Seventy-Five 546.54 KB

In 2004, Americans celebrate, if that is the right word, the 75th anniversary of the Great Stock Market Crash of 1929. There had been market crashes before 1929. And there were crashes after 1929. But 1929 is still considered "The Big One." How did the Great Crash develop in 1929? What did we think of it as its 25th and 50th anniversaries in 1954 and 1979? And how might we view it now, at its 75th? Exploring these questions, I conclude that we need to forget some of what "everyone knows" about the Crash of '29.

Fall 2004 -

Financial History, Issue 82 567.85 KB

Back when the United States was primarily a primarily an agrarian society, the banker, the doctor, the preacher, the lawyer and, in a way, the bar owner, were the enduring pillars of each town. It was the town banker, however, who enabled the farm-centric communities to survive and thrive.

Fall 2004 -

Rings of Power 349.52 KB

On August 12, 1984, Peter Ueberroth stood in the Los Angeles Coliseum during the Olympic closing ceremonies, tears escaping his usually tight control as the 93,000-member audience stood and cheered. Other honors would follow, including recognition from "Time" as the magazine's Man of the Year, over President Ronald Reagan. Neither an athlete nor a statesman nor a celebrity, Ueberroth was a middle-aged entrepreneur from Southern California, a self-made man who had, in large part, made the Games of the 23rd Olympiad happen -- and not only happen, but succeed on a spectacular level. In doing so, he changed many of the financial rules by which the Olympics had been played.

Spring 2004 -

Still They Ride 875.99 KB

Now that the fossil record clearly shows that some dinosaurs evolved into birds, it should not be such a surprise that almost all of the first 12 companies on the Dow Jones Industrial Average (DJIA) are still around. Their names reek of turn-of-the-century incipient industrialism: Tennessee Coal & Iron, American Cotton Oil, Distilling & Cattle Feeding. But well into the Information Age, only one on the debut list of May 26, 1896 is entirely gone. The U.S. Leather trust, the only preferred issue of the first Dow Dozen, was dropped in 1905. The trust was dissolved in 1911, and hardly a trace of the company or the industry remains in this country.

Winter 2004 -

Women on Wall Street: An Historical Perspective JPG 7.11 KB

In Martin Fridson's book, "It Was a Very Good Year: Extraordinary Moments in Stock Market History," 1954 ranks as the second best year of the 20th century for market returns as measured by the Standard & Poor's 500 Index (52.62 percent). It was also the year that the Dow finally regained its pre-1929 high of 381.37 and soared past the 400 mark for the first time. Fridson also notes the arrival of Muriel Siebert on Wall Street in 1954. Siebert, who established a successful career in a male-dominated industry, is probably best known as the first woman to own a seat on the New York Stock Exchange (NYSE). Siebert was not the typical career woman of the 1950s, but her struggle to overcome prejudice and discrimination on Wall Street caused us to wonder: What does it take for a woman to achieve prominence and respect on Wall Street?

Fall 2003 -

Emerging Stock Markets in the People's Republic of China 911.84 KB

2004 marked the 20th anniversary of the re-emergence of securities trading in the People's Republic of China. In 1984, the government approved the issuance of the first publicly issued stock since 1949. The issuing company was the state-owned Beijing Tian-Quio Department Store, which issued a three-year fixed interest rate stock that resembled a three-year bond in Western financial markets. Beginning in 1990, China also permitted the establishment of 24 regional stock exchanges to trade the slowly expanding number of new shares. In late 1990, China formally re-established two fully functioning national stock exchanges, one in Shanghai and one in the southern Chinese city of Shenzhen. All Chinese share trading was gradually moved to these two exchanges, beginning in late 1990. After 12 years of rapid growth, China again became a major stock market in the Far East, third in size after Japan and Hong Kong.

Spring 2003 -

From Soap Suds to Beer Suds 613.01 KB

One out of every two beers sold in the U.S. is brewed by Anheuser-Busch of St. Louis, MO. The family-run company traces its origins to the 1860s, but 2002 marks the first time in the company's 142-year history that its president and chief executive will be a non-family member.

Winter 2002 -

Big Bucks for Big Business JPG 5.76 KB

The development of underwriting syndicates is a phenomenon of late 19th century America arising out of the need for investment banks to pool their own capital to underwrite the new issue securities being sold to fund the growth of American industry. The railroad, steel, mining and utility industries all had significant capital requirements.

Summer 2002 -

The Men Who Would be King 513.66 KB

Long before Enron, Samuel Insull, Richard Whitney and Charles Keating were bilking investors out of millions, infuriating investigators, embarrassing politicians and forever endearing themselves to headline-hungry journalists.

Spring 2002 -

Financial History, Issue 94 306.21 KB

How a Group of Business Students Sold Enron

a Year Before the CollapseIt is Wall Street lore that no one saw the collapse of Enron coming. Chairman Kenneth Lay, CFO Andrew Fastow, COO Jeffrey Skilling and their band of brigands had done such a good job of fooling accountants, auditors, investors and regulators that the implosion was a shock to all. Like much received wisdom on Wall Street, this is not entirely true.

Spring/Summer 2009

Winter 2024

Financial History, Issue 148

In this issue:

- "The Unexpected Legacy of a Prudent Man," by Mark Higgins

- "The Russian Debt Default, 25 Years Later," by Peter C. Earle

- "Anna Sutherland Bissell: America’s First Female CEO," by Stephanie Forshee